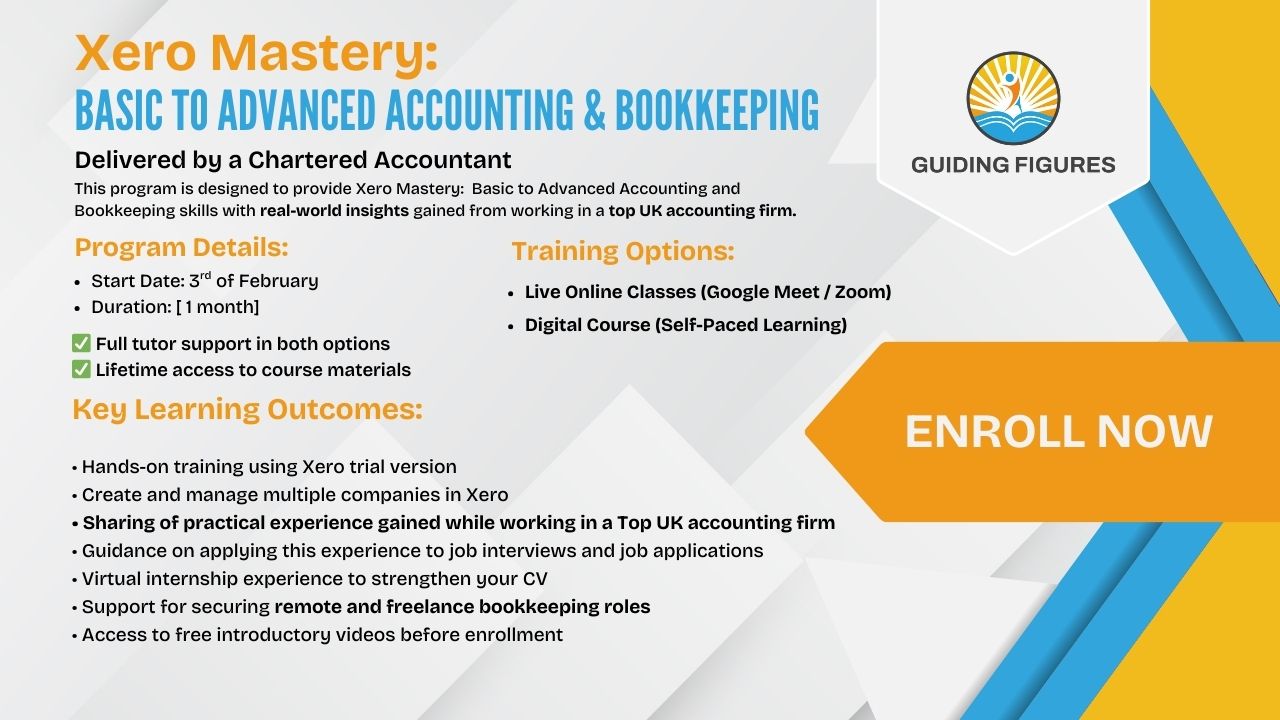

Xero Mastery: Basic to Advanced Accounting and Bookkeeping

This course covers the Full Accounting Cycle, beginning with Company Creation and the setup of accounting systems, followed by Purchases and Sales, Recording and Reconciling Transactions, including Credit Notes, Refunds, Overpayments, Bad Debts, and Deferred Income. It also addresses Foreign Currency Transactions, the complete management of Fixed Assets from recording and reconciliation to depreciation and error resolution, and the use of Director’s Loan Accounts (DLA). Additional areas include Accruals and Prepayments, Petty Cash, common Bank Reconciliation Issues, and the handling of Cheques and Bounced Cheques, along with other important accounting adjustments and reporting considerations.

The objective of the course is to develop strong Practical Accounting Skills, enabling learners to confidently create and manage companies, maintain accurate financial records, reconcile accounts, and resolve everyday accounting issues efficiently.

Usman Ali (Chartered Accountant and PTLLS -Teaching qualification -Level-3)

Category: Accounting